How Investment Representative can Save You Time, Stress, and Money.

The Investment Consultant PDFs

Table of ContentsThe 30-Second Trick For Lighthouse Wealth ManagementLittle Known Facts About Tax Planning Canada.What Does Independent Financial Advisor Canada Mean?The Best Strategy To Use For Ia Wealth ManagementSome Known Facts About Retirement Planning Canada.Excitement About Investment Representative

“If you had been to get an item, say a tv or a personal computer, might need to know the specifications of itwhat are their components and exactly what it can do,†Purda explains. “You can think of purchasing financial advice and assistance in the same way. Individuals need to know what they are getting.†With monetary information, it's important to understand that the item is not bonds, stocks or other financial investments.it is things like budgeting, planning pension or reducing debt. And like buying a personal computer from a trusted business, customers need to know they've been buying economic information from a dependable professional. One of Purda and Ashworth’s best findings is approximately the costs that financial planners demand their customers.

This conducted true it doesn't matter the cost structurehourly, payment, possessions under management or predetermined fee (in the research, the dollar value of fees was the same in each instance). “It nonetheless relates to the value proposal and anxiety throughout the consumers’ part that they don’t determine what they might be getting into trade for these fees,†says Purda.

Our Independent Financial Advisor Canada Statements

Hear this post whenever you notice the expression economic advisor, exactly what one thinks of? Many people contemplate a specialized who can provide them with economic information, especially when you are considering spending. That’s an excellent starting point, but it doesn’t decorate the entire image. Not really near! Monetary advisors enables people with a lot of various other money goals also.

An economic consultant will allow you to develop wealth and protect it for long haul. They may be able calculate your own future economic requirements and program tactics to extend your own your retirement cost savings. They can in addition help you on when to begin making use of personal protection and utilizing the income inside retirement accounts in order to stay away from any nasty penalties.

All About Investment Consultant

They're able to support find out what common resources are best for your needs and explain to you how-to handle making the absolute most of one's financial investments. They can in addition support understand the risks and just what you’ll should do to attain your aims. An experienced investment professional can also help you remain on the roller coaster of investingeven as soon as your investments simply take a dive.

They can provide advice you visit this site ought to generate an agenda so you're able to make sure that your desires are executed. And you can’t put a price tag on comfort that include that. In accordance with research conducted recently, the common 65-year-old few in 2022 needs about $315,000 conserved to pay for healthcare expenses in your retirement.

The Best Strategy To Use For Investment Representative

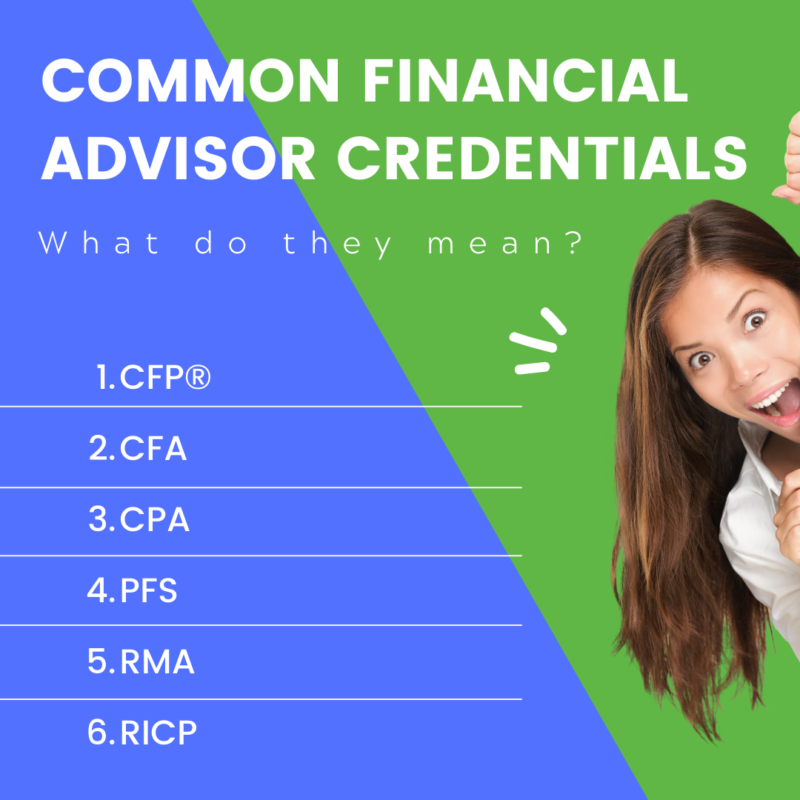

Given that we’ve gone over what economic analysts would, let’s dig to the different kinds. Here’s a great guideline: All economic coordinators are monetary experts, although not all analysts tend to be coordinators - https://dzone.com/users/5075253/lighthousewm.html. An economic planner concentrates on assisting men and women create plans to achieve long-lasting goalsthings like beginning a college account or conserving for a down cost on a property

How do you know which monetary expert is right for you - https://pagespeed.web.dev/analysis/https-www-lighthousewealthvictoria-com/drv8epdit8?form_factor=mobile? Below are a few things you can do to be sure you’re employing best individual. What now ? if you have two bad choices to select from? Easy! Get A Hold Of even more solutions. The greater amount of choices you may have, the much more likely you might be to help make an effective choice

Everything about Investment Consultant

Our Smart, Vestor plan causes it to be possible for you by showing you as much as five economic analysts who are able to serve you. The best part is actually, it’s free to get linked to an advisor! And don’t forget to come calmly to the interview prepared with a list of concerns to inquire of so you can decide if they’re a great fit.

But pay attention, because a specialist is actually smarter versus normal keep doesn’t let them have the right to show what direction to go. Occasionally, advisors are loaded with on their own simply because they convey more degrees than a thermometer. If an advisor begins talking-down to you personally, it is time to suggest to them the doorway.

Understand that! It’s essential that you as well as your financial expert (whoever it eventually ends up becoming) are on similar page. You need an advisor who's a long-term investing strategysomeone who’ll convince that hold investing constantly if the marketplace is up or down. independent investment advisor canada. Additionally you don’t should assist someone that forces you to definitely put money into a thing that’s as well risky or you are not comfortable with

Private Wealth Management Canada Fundamentals Explained

That mix offers the variation you need to effectively spend for the longterm. As you study economic experts, you’ll most likely come across the word fiduciary duty. All this work implies is any advisor you employ must act such that benefits their own client and not unique self-interest.